Australia and New Zealand, with our awe-inspiring landscapes and a deep appreciation for outdoor recreational activities, have become hotspots for the booming recreational vehicles (RVs) and boating market.

Recreational Vehicles Market in Australia.

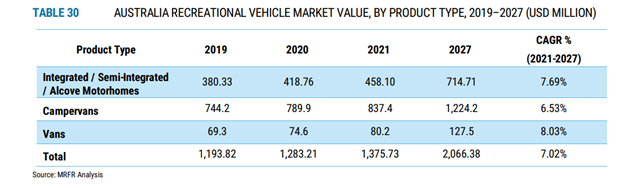

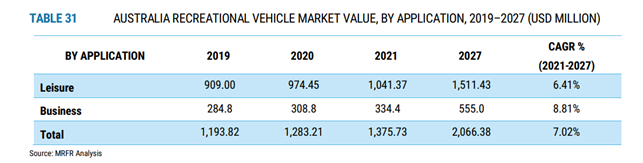

Australia has established itself as a leading country in motorhome and caravan sales, thanks to the growing production and demand for vehicles that offer both comfort and performance. The rise in recreational activities and urbanisation has further fueled the market's growth. In 2020, the campervans segment dominated the market with a value of $1,172,448,570 AUD while the vans segment is projected to witness the highest compound annual growth rate (CAGR) of 8.03% over the forecast period. Moreover, the leisure segment accounted for the largest market share in 2020, valued at $1,446,863,360 AUD with the business segment expected to experience the highest CAGR of 8.81%.

Motorcycles Market in Australia.

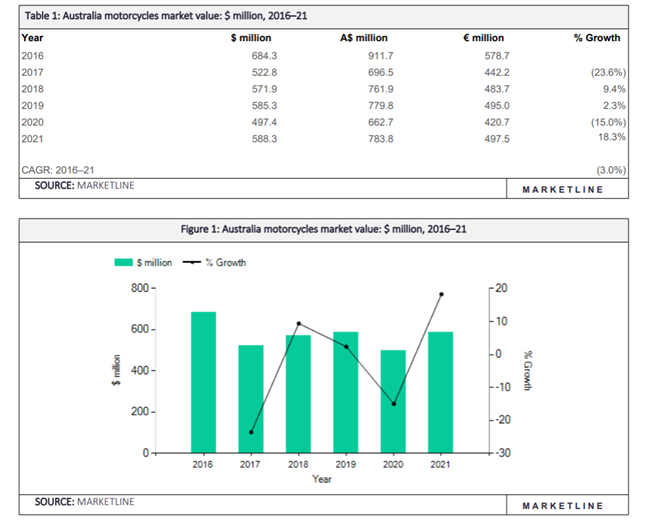

The Australian motorcycles market experienced significant growth in 2021, with a 16.6% increase in volume and an 18.3% increase in value. Motorcycles comprise the largest segment, accounting for 92.8% of the market's total volume. Honda leads the market with a 27.2% share. The presence of large multinational companies and emerging manufacturers has intensified competition in the market. Industry players face the challenge of complying with tighter environmental regulations while embracing advancing technologies.

Boating Market in Australia.

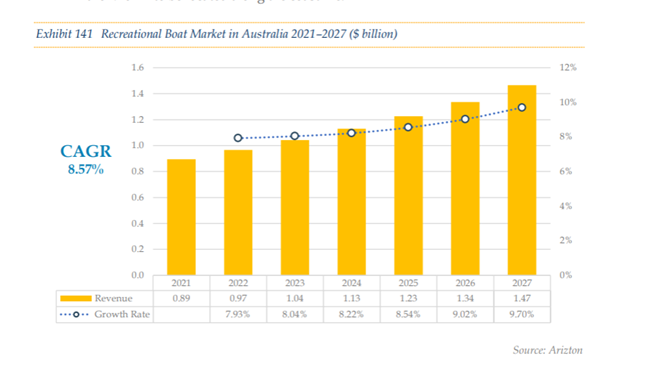

With our vast coastline and a population largely concentrated along the coastal regions, Australia offers ample opportunities for boating enthusiasts. Approximately five million people engage in leisure boating, making it a popular recreational activity across the country. The recreational boat market in Australia was valued at $1,322,006,000 AUD in 2021 and is projected to reach $2,184,861,000 AUD by 2027, exhibiting a CAGR of 8.57%. Shipments are also expected to increase from 18,853 units in 2021 to 25,460 units in 2027, reflecting a CAGR of 5.13%.

The Australian and New Zealand Connection.

Trade agreements, such as the Australia-US free trade agreement, have played a vital role in fostering international relations and supporting the growth of the recreational vehicles and boating market. While import restrictions are generally not a major concern, exporters need to be mindful of Australia's specific regulations, including electrical wiring specifications. Establishing a strong network with local distributors becomes crucial for exporters aiming to tap into the Australian market successfully. In New Zealand, the recreational boat market was valued at $698,279,000 AUD in 2021, and it is projected to reach $1,129,132,000 AUD by 2027, demonstrating a CAGR of 8.39%. The stable exchange rates have contributed to the profitability of foreign brands, resulting in increased boat sales.

While global uncertainties and rising inflation have dampened consumer confidence in various sectors, the industries remain optimistic about the future, despite facing headwinds. They continue to focus on innovation and the transition towards a low-emissions environment, along with adapting to tightening economic conditions.

Empowering Expansion

As the recreational vehicles and boating market in Australia and New Zealand continues to grow, manufacturers and dealers face various challenges, especially when it comes to importing vehicles. However, with the support of a global finance provider, such as DLL, navigating these challenges becomes more manageable. A global finance provider brings a wealth of experience in international trade and may be more willing to fund imports at the Bill of Lading (BOL), which can significantly help manufacturers and importers with their cash flow management. Moreover, DLL's expertise extends beyond the borders of Australia and New Zealand, as we are actively involved in over 25 countries worldwide. With more than 50 years of experience, DLL understands the unique needs of manufacturers and dealers in the Australian and New Zealand markets. In addition, DLL's connection to the Rabobank Group, a reputable global financial services provider, further solidifies their position as a reliable partner for businesses in the recreational vehicles and boating industry.

As the recreational vehicle and boating industry continues to thrive in Australia and New Zealand, engaging a floorplan finance partner like DLL becomes an attractive option for manufacturers and dealers alike. A floorplan finance solution enables manufacturers to efficiently get their equipment into dealer and distribution channels by offering comprehensive financing options to support business growth. On the other hand, qualified dealers can leverage credit lines from DLL to finance purchases from manufacturers, thereby increasing their inventory without tying up capital.

Australia and New Zealand's shared enthusiasm for outdoor recreational activities, along with their unique landscapes, have created a robust market for RVs and boating. The industry's contribution of $39,835,800,000 AUD annually to the Australian economy underscores its significance. With DLL's tailored floorplan finance solutions, manufacturers and dealers can optimize their cash flow, increase purchasing power, and capitalize on the opportunities for exploration, adventure, and enjoyment offered by both countries' recreational vehicles and boating market.

To learn more about DLL’s floorplan finance solutions, visit our Commercial Finance webpage.

Note: The information provided is based on the data available up to September 2021. Market trends and figures may have evolved since.