A new era for leasing began on January 1, 2019 when the new IFRS 16 lease accounting standards went into effect.* This represents a fundamental change in how companies account for leases, and many companies have been intensively preparing for this transition. But this is uncharted territory for everyone. How do you know if you have done enough to prepare? DLL, a global financial solutions provider and wholly owned subsidiary of Rabobank, describes the 7 common pitfalls it has experienced while helping some of the world’s largest corporations prepare for IFRS 16. Together with our customers, we are exploring innovative financing solutions that will help them take the best possible advantage of the new leasing standards.

“At DLL, we have spent the last few years preparing extensively for the transition to IFRS 16 – during our own transition as a multinational corporation, and as a lessor and advisor to major companies across diverse industries,” says Stijn Vogel, CFO of the CCO domain at DLL. “In this article, we’d like to share some insights we have gained in this process to help companies avoid unpleasant surprises and expensive mistakes and make the new IFRS 16 standards work to their benefit.”

Pitfall 1 Looking at IFRS 16 as a Finance issue alone

So, you’ve implemented new processes to involve your Finance department in your new accounting and reporting. You’ve re-defined your key financial ratios and performance metrics, such as gearing, current ratio, asset turnover, interest cover, EBIT, operating profit, net income, EPS, ROCE, ROE, and operating cash flows. But there is still more you have to consider.

DLL perspective

IFRS 16 can have a cumulative affect across your organization – on the business, operations, systems, processes and controls. You may have already updated your existing IT systems or implemented a new data management system, but have you also looked at making changes to, for example, your procurement processes and fleet management strategy? Have you redefined KPI’s for your staff and considered other aspects to efficiently address the new situation?

Pitfall 2 Using non-standardized accounting processes

You may have changed your leasing and rental contract processes at a corporate level, but many corporations do not realize how important it is to standardize their accounting processes down to every single subsidiary across the globe. Many corporate finance functions ask for the required information only once or a few times per year. At the local level, this runs the risk that no proper reporting process is set up and that this remains an ‘ad hoc’ exercise every time.

DLL perspective

We recommend setting up a project structure to standardize accounting processes at every level. It’s important to involve corporate finance managers and local finance managers to leverage best practices and process efficiencies.

A key recommendation is to require a set of relevant data fields as part of the monthly reporting cycle, so that this really gets embedded in the organization and enables best practices to be shared among the group companies.

Pitfall 3 Following the letter of the law

Most companies are so busy trying to meet the exact requirements of the new regulations, they can miss opportunities to use the new regulations to their advantage.

DLL perspective

These new leasing standards are unknown territory and their impact is often very customer specific, so leasing companies are playing it safe when it comes to the options they offer their customers. There are many opportunities within the new standards to innovate new leasing options. We are actively working with our customers to find ways to reduce the impact of their leases on the balance sheet and come up with innovative financing options that will help them take advantage of the new standards. Think about variable payment solutions, shorter term leases, outsourcing constructions…

Pitfall 4 Discarding leasing altogether

With operational leases now going on their balance sheet, many companies are asking themselves if it’s still worthwhile to continue leasing. Why not just borrow money from a bank or buy equipment outright?

DLL perspective

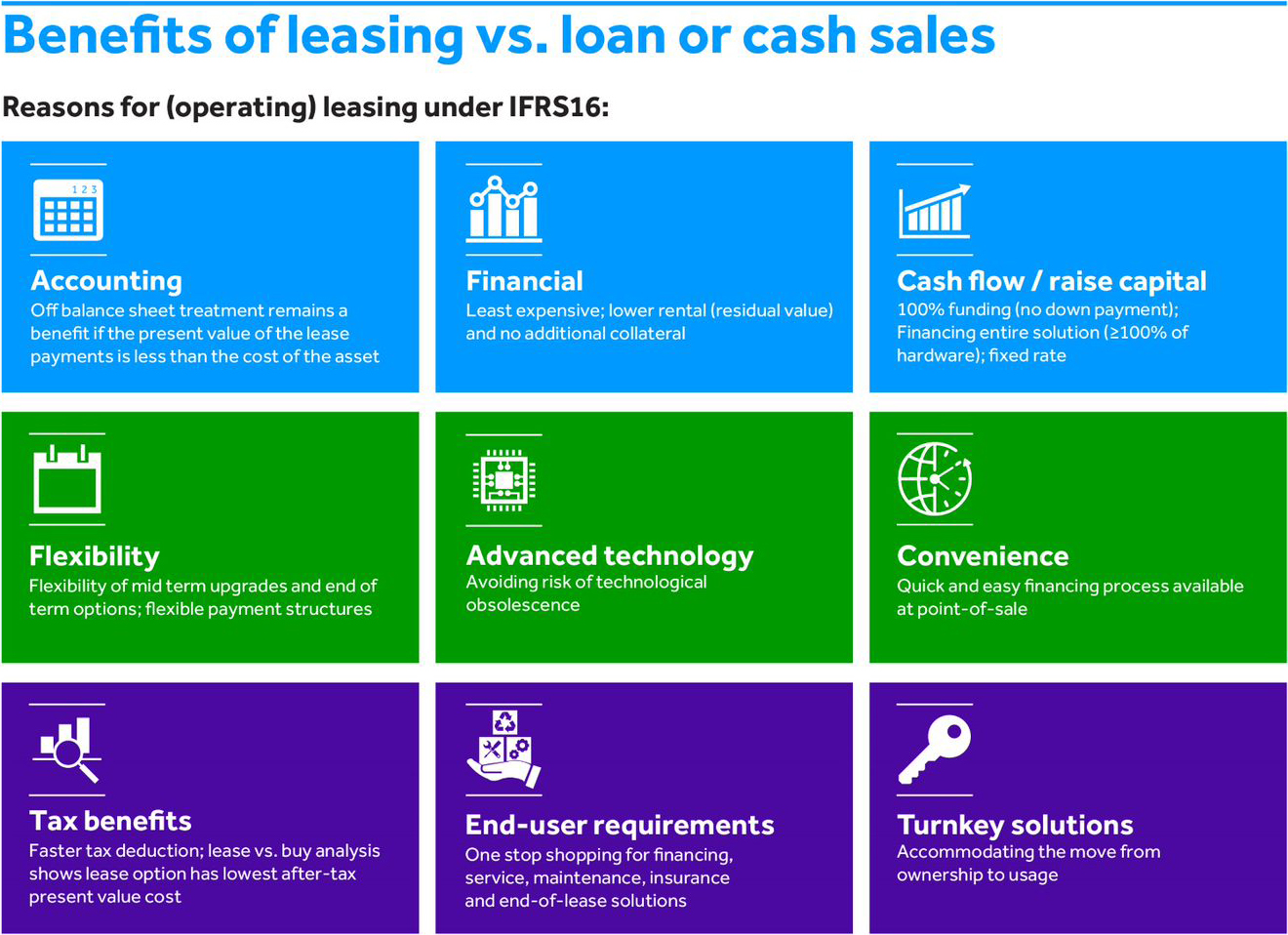

The answer depends on how your business uses leases to finance assets, but in most cases the advantages of leasing versus loans or cash purchases still far outweigh the disadvantages of putting equipment on the balance sheet. The Finance, Operations and Procurement departments can each provide valuable input to answer this question.

Pitfall 5 Forgetting why you were leasing in the first place

With the new regulation, a part of the off-balance sheet treatment may cease to exist. However, if the off-balance aspect was the only feature that made it worthwhile to lease, leasing would never have been economically viable as a business for leasing companies or as a finance solution for their customers. Also, from an ethical point of view, that would be a very questionable practice….

DLL perspective

It’s important not to lose sight of why you were leasing in the first place. Off-balance has always been a nice side-benefit of leasing but was never the main reason to lease. In the end, you start a lease contract to benefit from the use of assets in your organization without needing to pay for the investment in advance. That benefit does not change with the new regulations.

Pitfall 6 Not involving your network

You have spent the last two years assessing your inventory and putting new processes in place, but perhaps your suppliers are also in a position to help.

DLL perspective

We’ve already seen many examples where companies have asked their suppliers to come up with solutions, but many are struggling to understand the accounting ramifications for their products and processes. They know a lot about the products they sell but lack the financing expertise to come up with creative solutions to your challenges. Ask your equipment or leasing supplier how they can help you, always keeping in mind the benefits you aim to achieve with leasing.

Pitfall 7 Failing to change your mindset

You’ve made a complete inventory of your lease and rental contracts. You have detailed spreadsheets listing all kinds of data for every single piece of equipment in every location. You’ve collected information on all the non-lease components, like operations, maintenance services, etc. This takes a tremendous amount of effort for most large corporations, but all of this work can go to waste if you do not make one fundamental change – we’re talking about the change in your mindset.

DLL perspective

We have seen that most companies are still making their lease or buy decisions based on their old way of thinking. They’ve made a complete inventory of their leases, but they haven’t really looked at how the new standards will impact their operational procedures around the investment decisions they make. For instance, before IFRS 16, rental and leasing contracts fell under the annual budget, so no finance department would be involved. In the new situation, finance aspects are involved, so rental and leasing contracts become a CAPEX instead of an OPEX discussion. Have you changed your operational procedures to involve finance in the process? More importantly, are you now thinking about your equipment needs in terms of a capital expenditure in addition to an operational expenditure?

The road to better decisions

This is just the beginning for the new IFRS 16 landscape. At DLL we believe IFRS 16 will deliver transparency and a truer picture of a company’s assets and liabilities, which will ultimately lead to better decisions. Whatever challenges you face, we want to support you. Leverage our 50 years of experience in financing innovations and in supporting large fleet users across diverse industries to make IFRS 16 work for you. By building on our strengths we can find creative ways to reap the benefits of the new leasing standards.

For more information, read

The IFRS 16 standard - a new reality in lease accounting.

Questions? Contact Marco Wagner, DLL

* International Financial Reporting Standards (IFRS) are applicable to many parts of the world, including the European Union (EU) and many countries in Asia and South America, but not in the United States. The Accounting Standard Codification (ACR) 842 standardizes new lease accounting changes in the United States.