Cloud investments are expected to continue through 2021, remaining a key investment area for businesses in order to maintain and strengthen operations.1

This year, we also witnessed an increased focus on security, in part due to the rapid shift to remote working. This area is expected to remain steady as organizations think long-term about new security threats in our work-from-home environment.

The virtual setup drove a resurgence in the PC and tablet markets, and demand for these assets continues to outpace supply.

Telecommunication and government investment in 5G have remained on track and will continue being a hot area to watch as we head into 2021. For consumers, the latest iPhone is equipped with 5G capabilities, and IDC expects that 30 percent of enterprises will provision 5G PCs by 2022 as many employees will continue working from home permanently.2 By 2025, 75 percent of industrial enterprises are expected to adopt private 5G networks.3

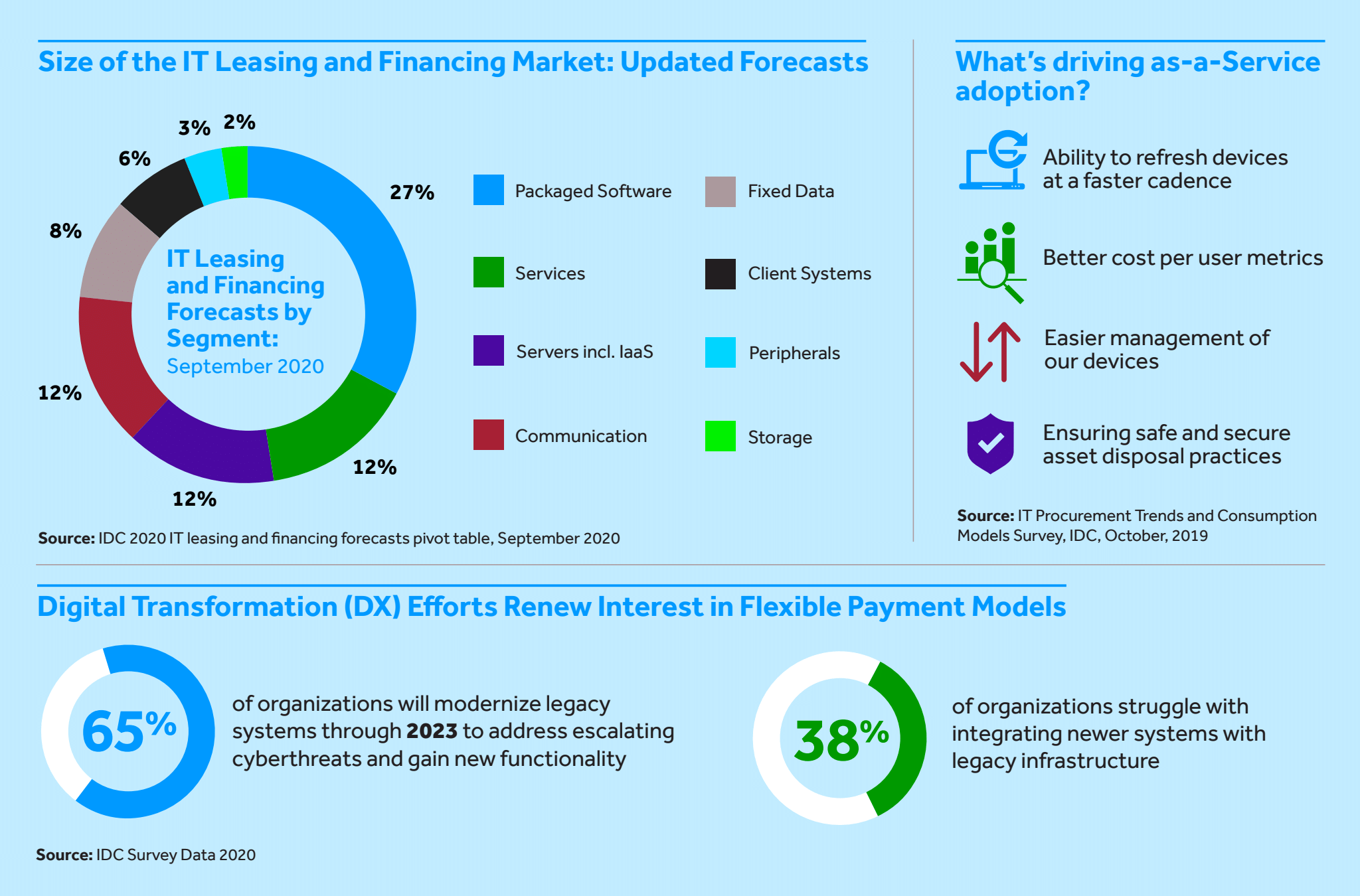

All of this investment in technology is driving growth in IT leasing, financing and as-a service models. IDC notes that overall IT leasing and financing in 2020 is forecasted to reach $273 billion and is forecasted to reach $360 billion by 2024.4

Software financing remains a strong segment as organizations rely on applications to accelerate business operations. Investments in hardware will continue on a cyclical basis driven by upgrade cycles and new product announcements.

Digital transformations and the shift to multi-cloud models have largely driven organizations’ IT investments. This year has amplified the desire to conserve capital and have flexibility with asset management, budgets and payments. Flexible payment models have become an especially attractive option to preserve cash, particularly when there is economic uncertainty. This trend is for both end-user customers as well as channel partners, who can partner with a commercial or inventory finance partner to bridge a gap in their cash flow from when they receive payment from a customer to when the vendor needs to be paid.

If you missed the webinar, follow the links below to watch a full recording and hear more on what’s driving IT investment strategies as we head into 2021 as well as case studies about how channel partners helped manage customers’ payment requirements.

U.S. webinar recording

European webinar recording

1 IDC Press Release, IDC Announces Key Technology Investment Trends for the Future Enterprise, October 2020

2 IDC FutureScape: Worldwide Connected Devices and Consumer DX 2021 Predictions, October 2020

3 IDC FutureScape: Worldwide Future of Connectedness 2021 Predictions, October 2020

4 IDC, Tech Trends LIVE: Insights into How Customers will Invest inTechnology in 2021, October 2020