What is inventory finance?

In the food and agriculture sector, inventory finance can also be referred to as “floor planning” or “wholesale finance.” In general, this directly benefits manufacturers, distributors, and dealers by providing a line of credit or short-term loans for inventory. The industry typically follows a pay-as-sold or scheduled pay model, meaning the dealer can purchase inventory without upfront costs. Dealers have an extended period to repay the manufacturers and distributors over time. Often, manufacturers and distributors choose to work with a vendor finance company to provide dedicated credit lines to dealers for floor planning.

What products can be financed through a floor planning program?

Dealers can purchase tractors, planters, combine heads, mowers, golf carts, UTVs, fertilizers, seeds, irrigation systems, parts, consumables, and much more.

How does floor planning work?

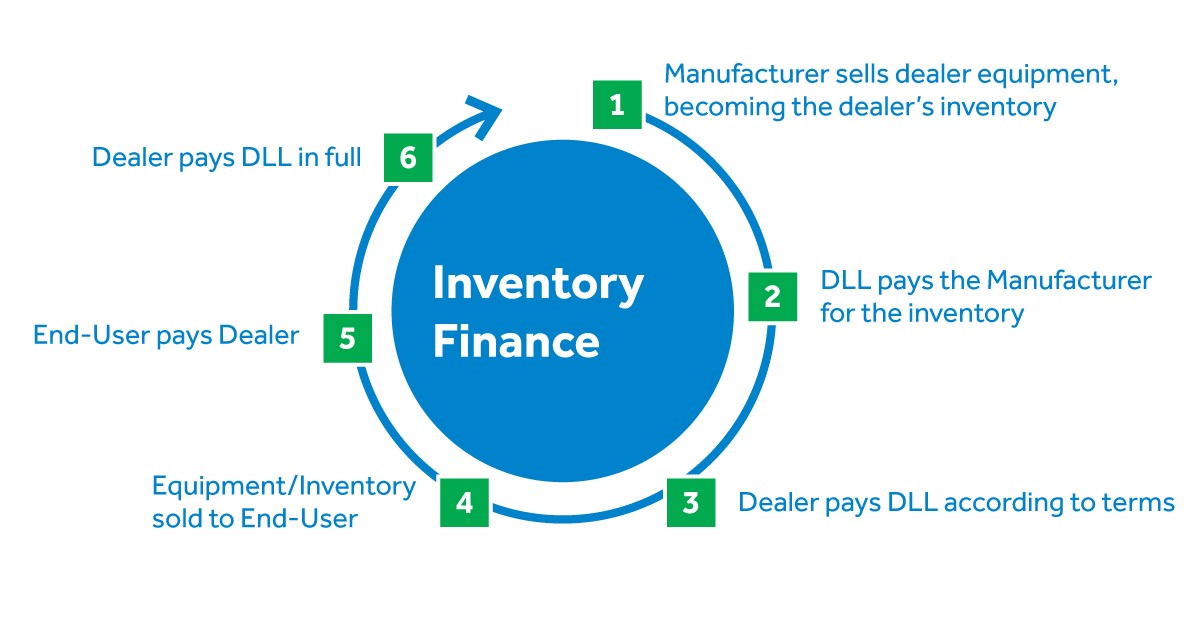

When a manufacturer or distributor partners with a finance company for floor planning, the dealer will purchase equipment directly from the manufacturer using a dedicated credit line from the finance vendor.

Instead of the dealer, the vendor finance company will pay the manufacturer or distributor within a short period of time for the dealer’s purchases.

In a pay-as-sold model, the dealer has a specific time frame to sell the products based on terms between the manufacturer and the finance vendor. Once the product is sold, the dealer will pay the finance vendor based upon the contractual terms.

This is different from a scheduled pay model, where the dealer purchases products from the manufacturer and the manufacturer receives payment from the vendor finance company. The dealer then has an extended period of time to repay the vendor finance company with interest-free terms.

What are the benefits of floor planning for food and agriculture manufacturers and distributors?

- Delivers Revenue Recognition. Floor planning allows the manufacturer or distributor to record revenue quickly.

- Drives increased dealer purchasing power. Dealers may purchase more products at once from the manufacturer due to the pay-as-sold terms and extended payment options. This can increase revenue for the manufacturer and distributor.

- Helps with inbound cash flow. Manufacturers will receive payment very quickly from the finance vendor.

- Establishes a strong dealer base. Dealers and end-users are also concerned with their cash flow, so they may be more likely to do business with a manufacturer that offers a financing program. This provides the manufacturer with the ability to form long-lasting business relationships with their dealers.

- Transfers credit risk and billing responsibilities. The finance vendor will assume these responsibilities so that manufacturers have more time to focus on other aspects of their business.

What are the benefits of floor planning for food and agriculture dealers?

- Increases purchasing power. Through higher credit lines, dealers can purchase more equipment at once, thereby keeping their lots fully stocked with more inventory on-hand to be prepared for customer demand.

- Improves cash flow management. A dealer has a dedicated line of credit available which reduces their cash outflows.

- Offers flexible payment terms. Through a vendor finance program, longer and more flexible payment terms are available than what would be offered by a bank or manufacturer directly.

What should food and agriculture manufacturers or distributors look for in an inventory finance partner?

Ultimately, one of most important factors in looking for a partner is ease of doing business and exceptional customer service. Food and agriculture manufacturers or distributors should consider looking for a finance vendor that understands the details of their business and offers flexibility and reliability to its customers. It is important to partner with a vendor who offers customized solutions tailored to a business’ industry-specific needs, sales cycles, and long-term goals.

Another helpful aspect is a vendor who offers an easy-to-use online portal that provides all entities with a platform containing understandable reporting and transparency. This is similar to a banking app that is available 24/7 to access all necessary information at the benefit of the manufacturer, distributor, or dealer. Functions of this portal can include access to credit line information, recent transactions, and even insight on what products are most frequently ordered and in stock.

Lastly, consider looking for a finance vendor that understands the individualized needs of the business and has a desire to work together to form a long-term relationship that is beneficial to any unique business situation.

DLL has 50 years of experience in the food and agriculture industry globally. We understand the importance of offering proven tailored solutions with exceptional customer service to all our valued business partners.

Eighty-three percent of our 2019 Food and Agriculture partners remarked they were very satisfied with doing business with DLL1. Here is what they have to say:

- “DLL is simply great at helping us and helping our customers. With DLL we get deals done which benefits everyone.”

- “We are very pleased with pretty much every aspect of dealing with DLL. From ease of use to being able to contact a real person and get answers.”

- “DLL is always willing to work outside the box and assist with new situations to make our business more efficient by streamlining processes and being flexible with our credit needs.”

Learn more about Floor Planning at DLL

Source:

1 DLL 2019 Loyalty Survey