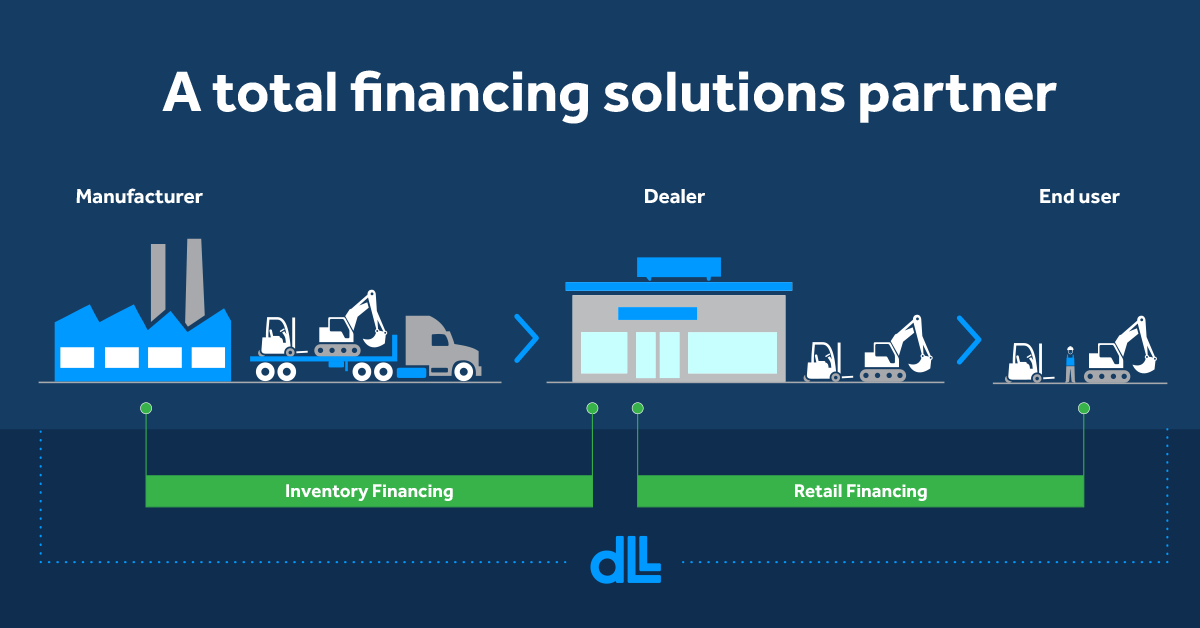

In the fast-paced world of equipment sales, having the right financing solutions at every stage of the supply chain is critical. Dealers need financing solutions that work as hard as they do. Managing inventory, cash flow, and customer demand requires flexibility, and having the right financial partner can make all the difference.

At DLL, we provide a comprehensive financing approach designed to support dealers - ensuring smooth inventory management, optimized cash flow, and increased sales potential. Here’s why a total financing solution is the ultimate game-changer.

Inventory Financing: A Smarter Way to Manage Stock

Inventory finance is a strategic financial tool that allows dealers to effectively manage their stock and cash flow. It’s not just a financing solution - it’s a partnership between manufacturers and dealers designed to optimize operations and drive business growth.

Manufacturers often collaborate with financing providers to establish a credit line for their dealers, enabling them to acquire inventory with extended payment terms. This is commonly structured as a pay-as-sold (PAS) model, where dealers only pay for the equipment once it has been sold. This financing structure eliminates the burden of large upfront costs, fostering financial stability.

Key Benefits of Inventory Financing

- Increased purchasing power – Stock a wider range of products, giving customers more choices and strengthening your competitive edge.

- Improved cash flow management – Reduce excessive borrowing and operate with financial flexibility.

- Boosted sales potential – Unlock new revenue streams by offering strategic financial solutions to your customers.

- Simplified inventory management – Use an intuitive online portal to streamline operations and enhance efficiency.

Close More Deals with Flexible Leasing Options

Customers need affordable, flexible ways to acquire either construction or material handling equipment. DLL’s leasing programs give end-users the ability to finance equipment without large upfront costs, making it easier for you to close deals and build long-term customer relationships.

At the end of a lease term, customers have multiple options:

- Purchase the equipment at a predetermined price.

- Return the equipment to the dealer.

- Upgrade to newer models to stay ahead of evolving technologies.

For dealerships, leasing not only creates recurring revenue but also fosters strong customer retention. By offering flexible financing options, dealers can build lasting relationships and encourage repeat business.

How Leasing Benefits Your Dealership:

- More repeat business - Keep customers engaged with upgrade and renewal opportunities.

- Higher customer loyalty - Strengthen long-term relationships through flexible financing options.

- Predictable deal pipeline - Ensure a steady flow of deals with structured leasing plans.

- Better customer experience - Provide an effortless financing experience, making it easier for customers to acquire equipment.

Why Dealers Choose DLL

A strong financing partner gives you a competitive edge. DLL delivers dealer-first financing solutions designed to support your growth and success.

Why Partner with DLL?

- Global expertise, local support - Operating in 25+ countries, we provide industry-leading financing solutions backed by deep market knowledge.

- Dedicated Support Team - Our team provides personalized support, ensuring smooth operations and growth.

- Scalable Financing Solutions - Flexible financing options tailored to your business needs.

- Strong Financial Backing - As a wholly owned subsidiary of Rabobank, DLL offers unmatched financial stability and credibility.

- Industry Expertise - With decades of experience in equipment financing, we provide valuable market insights to help you navigate industry shifts.

Unlock the Full Potential of Your Business with DLL

With DLL’s total financing solutions, your dealership can optimize inventory, create a more predictable pipeline, and build lasting customer relationships. Let’s talk about how we can help you increase sales and strengthen your competitive edge.

Ready to take your business to the next level? Contact DLL today to explore how our tailored financing solutions can support your success.

All financing subject to credit review and approval and other terms and conditions. All financing is in DLL’s sole discretion.