Besides its many other objectives, HS2 aims to build the world’s most sustainable high-speed railway. HS2 suppliers can play a key role here by financing their equipment with a partner who is committed to the circular economy. In part 4 of our HS2 series, specialists at DLL, one of the top five Asset Finance companies in the UK,1 share advice on how HS2 suppliers can reduce waste in sourcing the equipment they need for HS2.

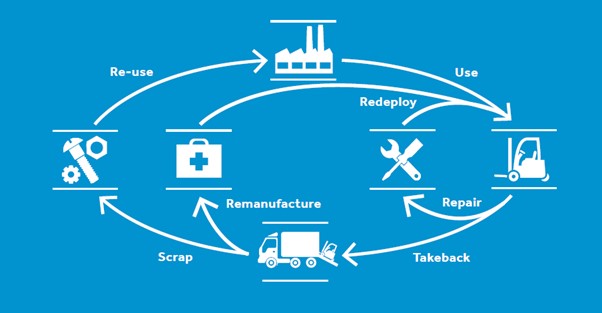

“At DLL, our passion is to provide sustainable business solutions through financing options that drive a low carbon footprint and promote a circular economy,” says Phil King, Global Head of Asset Management CT&I at DLL. “Besides operational lease, we offer other tailored financial solutions that fit the circular economy, like extended usage, redeployment and second life finance. That means we have thousands of assets that we are accountable for and that are coming back to us. It’s very important to us that we ensure that all the assets we own are used to the full extents of their capabilities.”

DLL Life Cycle Asset Management

“When HS2 suppliers finance their equipment with DLL, we advise them on how to obtain the highest possible value out of the equipment throughout its lifecycle,” says Mark Hield, Senior Account Manager, UK Fleet Solutions at DLL. “We can support them by bundling maintenance services in their financing contract and by extending finance contracts for equipment already purchased whilst waiting for replacement equipment.”

DLL can identify the optimal lifecycle of the equipment, which provides great insights into how to structure a lease to support the asset throughout its lifecycle and fulfil customers’ operational needs at the same time. “DLL has a dedicated team of Asset Management professionals who assess the assets and sector and set realistic residual values for construction equipment. When we receive the equipment back at end of lease our remarketing team uses their global network and expertise to ensure that the assets have a secondary and often third life in the market,” says Hield.

Global leader in aggregates funds new and used fleet of construction equipment

“We have a large revolving credit line in place for a global leader in the aggregates sector that has a significant annual replacement program on yellow plant,” says Hield. “Due to the recent supply issues across the globe, they have not been able to secure build slots for all new equipment required in 2021. We have helped the customer to source and fund used equipment to supplement the new equipment in the UK using our asset expertise and network contacts within our remarketing team. This has enabled our customer to continue critical business operations.”

Waste management leader focuses on financing to extend useful life of equipment

For a large customer in the waste management sector, DLL is funding an entire fleet of refuse vehicles on a fixed term operating lease. Hield says, “The customer wants to match the initial funding term to their end customer contract term, but with the option that if they secure a second term with their customer, they can run the equipment for its useful life. This gives them the flexibility of funding the assets linked to their contract terms, with the flexibility to hand back or extend if further business is won.”

Pay-per-use financing of lithium-ion batteries to stimulate adoption of this technology

The lithium-ion battery market for industrial use is expected to grow at a CAGR of 20% between 2014 and 2025. However, the high price of lithium-ion batteries has been a barrier to adopting the technology. With higher equipment costs, financing options are an ideal way to be able to make use of lithium-ion technology, and reduce the total cost of operation, without a higher initial outlay. DLL is currently developing pay-per-use solutions that will enable users to get the full benefit of using batteries without having to own them.

Global resources and underwriting capacity

“DLL is a global asset finance company for equipment and technology across industries, that serves over 30 countries,” says Phil King. “HS2 suppliers can draw upon our global resources and asset management experience to obtain the financing solutions they need to reduce waste on their equipment investments.”

DLL at UK Construction Week

Mark Hield and Phil King spoke at UK Construction Week about 5 ways to sustainably and efficiently acquire equipment for large scale construction projects. To learn more, download the resource here.

Let’s make history together

“This is a defining moment for the people in the UK, and we look forward to playing our part in writing this new chapter of history,” says Mark Hield. “We believe that by working together with a clear focus on our end goal, we have the potential to make this not only the biggest – but also the most successful infrastructure project of this century.”

For more information please contact us.

1 Annual Asset Finance UK 50 – 2020 rankings survey, published by Asset Finance Policy and Asset Finance International.