Beneficial changes to capital allowances

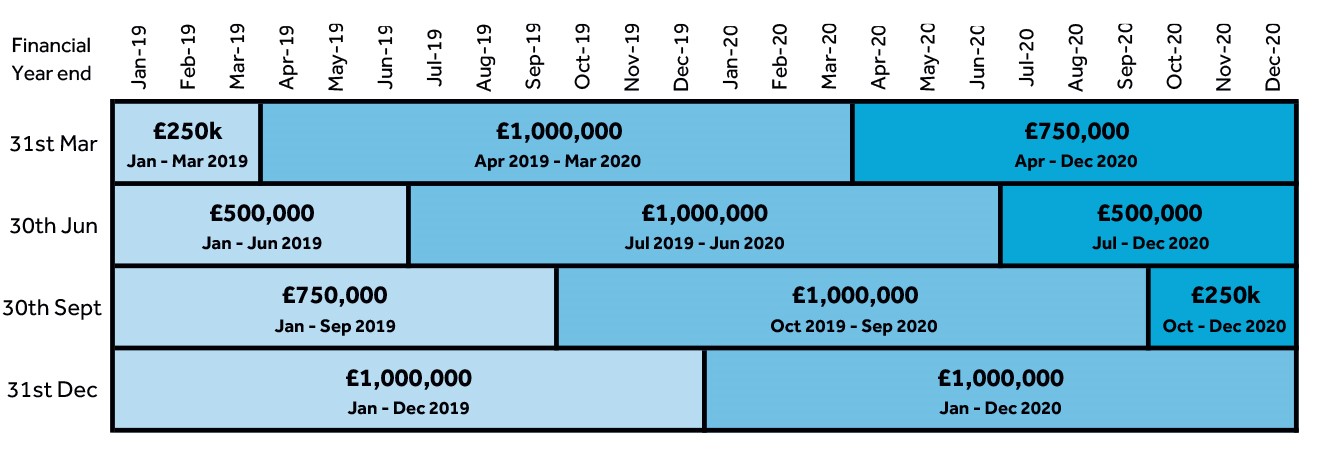

The United Kingdom Annual Investment Allowance has increased fivefold from £200,000 to £1,000,000 for a temporary period of two years, from 1 January 2019. Your business can take advantage of the Annual Investment Allowance changes, but the timing of your capital purchases is crucial to maximise your tax saving.*

How does the Annual Investment Allowance (AIA) work?

The annual investment allowance is designed to give 100% first year tax relief for qualifying expenditure on plant and machinery.

Simply put, a business with profits before tax of up to £1,000,000 could reduce its income/corporation tax bill to zero by purchasing new equipment of the same value. Annual expenditure above £1,000,000 will attract the usual 18% annual Writing Down Allowance (WDA).

What plant & machinery is eligible for the AIA? Plant & Machinery include the following items: